24+ tax relief letter sample

Fiscal Tax YearTax Roll Year A fiscal tax year runs from July 1 through June 30. Now that youve gotten your tax documents together you can call the IRS to ask for a tax penalty waiver.

Free 10 Tax Audit Report Samples Templates In Pdf Ms Word

We offer 247 essay help for busy students.

. Bankruptcies or tax liens. The letter will show your business tax ID and other identifying information for your business. For example Fiscal Tax Year 2018-19 runs from July 1 2018 through June 30 2019 and the Tax Roll Year is 2018-19.

These 80 letter-writing prompts are meant to give you ideas on what to. Acts 1985 69th Leg ch. Do late rent payments show up on my credit report.

The only way to get tax penalties waived is to request relief. While credit inquiries are typically the least significant scoring factor on your credit report accounting for approximately five points for each inquiry they can add up quickly if youre not careful. A tax roll year refers to the fiscal tax year.

This requires the filer to complete an IRS Form 945. Additionally the corporate alternative minimum tax is repealed for tax years beginning after. A client to whom the IRS grants an FTA will receive Letter 3502C or 3503C 30 for individual failure-to-file and failure-to-pay penalty abatement and Letter 168C or its equivalent 31 for business failure-to-deposit penalty abatement.

If you applied online for your EIN the IRS would have issued your confirmation letter right away. Military members are eligible to receive financial relief and protections under the Servicemembers Civil Relief Act SCRA. A Except as otherwise provided by this chapter all taxable property is appraised at its market value as of January 1.

THE NEW 2021 TAX SEASON HAS STARTED - WHAT YOU HAVE TO KNOW -ITR12s AND PROVISIONAL TAX Recording of a webinar on Jul 02 2021 at 830 AM CAT. On this webinar we will discuss the rules new features and. If you want to write a letter to the IRS to appeal an action or assessment they made make sure to consult a tax attorney to help you navigate the appeal process.

The IRS will not offer them to you even if you qualify. Hubers 11012021. 116-136 amended Internal Revenue Code section 172 to allow a carryback of any NOL arising in a tax year beginning after 2017 and before 2021 to each of the 5 tax years preceding the tax year of the NOL.

The SCRA formerly known as the Soldiers and Sailors Civil Relief Act is a federal law enacted in 2003 that restricts or limits actions against military personnel currently serving on active duty. We would like to show you a description here but the site wont allow us. The second 25000 exemption applies to the value between 50000 - 75000 and does not include a benefit on the school tax.

That since there is no tax relief to the donor for the 1000 In-Kind services donation perhaps it would be determined that the amount could be claimed. Intimation issued under Section 1431 making adjustments to the returned income. Scrutiny assessment order us 1433 or an ex-parte assessment order us 144 to object to income determined or loss assessed or tax determined or status under.

This might be very stressing due to inadequate time to do a thorough research to come up with a quality paper. Special Reports Structuring a Successful Drop-and-Swap. The start of new tax season is upon us.

15 applicable to fiscal-year corporations with year ends after that date. Order against tax payer where the tax payer denies liability to be assessed under Income Tax Act. After receiving the homestead exemption the first year any annual increase in the assessed value is capped at the lower of 3 or the percentage increase in the Consumer Price Index CPI with certain exceptions See.

Sample Motor Vehicle Tax-Exemption Letter. Susan Vonderhaar on January 24. It can and should only cite the value to the organization in the way I provide in the sample letter in the article.

The Coronavirus Aid Relief and Economic Security Act CARES Act PL. 31 2017 the corporate tax rate is a flat 21 with a blended rate Sec. As a busy student you might end up forgetting some of the assignments assigned to you until a night or a day before they are due.

The letter usually arrives about four weeks after the IRS grants the FTA. Achiever Papers is here to save you from all this stress. If relief is denied in part or in full and the requesting spouse petitions the US.

However the non-requesting spouse may not petition the Tax Court from the final determination letter. Act 326 Session Laws of Hawaii 2012 Relating to Taxation SUPERSEDED BY 2014-02. The district court may hear and determine any cause that is cognizable by courts of law or equity and may grant any relief that could be granted by either courts of law or equity.

Additionally the CH. The relationship you build with your sponsored child through letter writing is crucial in helping meet your childs needs. Christopher Truckers Relief Fund which helps truck drivers in.

Hubers argues that when co-owners hold property in a partnership the drop-and-swap technique offers a viable means to facilitate a section 1031 exchange for some partners while allowing others to cash out of the investment and part ways. APPRAISAL METHODS AND PROCEDURES. At the beginning of your letter be direct and state what you are appealing and identify the IRS decision letter by date.

Jason Meunier on June 23. A Credit Inquiry Removal Letter can be a relatively easy and effective way to improve your credit score. For example for tax years beginning after Dec.

Tax Court the non-requesting spouse by law will be given the opportunity to become a party in that proceeding. Know the tax form that was filed 1040 1065 1120S Have all returns filed. This payee must be subjected to backup withholding for all payments24 is the current rate.

Circumstances may arise where more favorable results are achieved by not operating as an S corporation. Civil court judgments including housing court actions filed by a previous landlord that may have led to eviction. A sample credit report is available from Experian one of the three national credit bureaus.

Robinson Foundation will donate 1 per thank-you message submitted up to 25000 to the St. Filing Date Extension and Estimated Tax Penalty Relief for Farmers and Fishermen. JURISDICTIONAL AMOUNT IF PARTIES PROPERLY JOIN IN ONE SUIT.

Free 8 Rejection Letter Templates In Ms Word Pdf

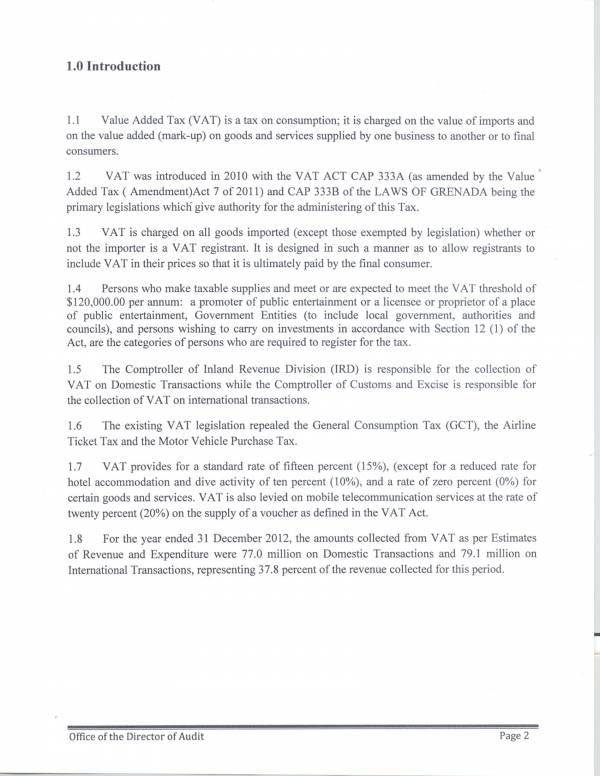

Free 10 Tax Audit Report Samples Templates In Pdf Ms Word

Accountant Reference Letter Templates 9 Free Word Pdf Documents Download Free Premium Templates

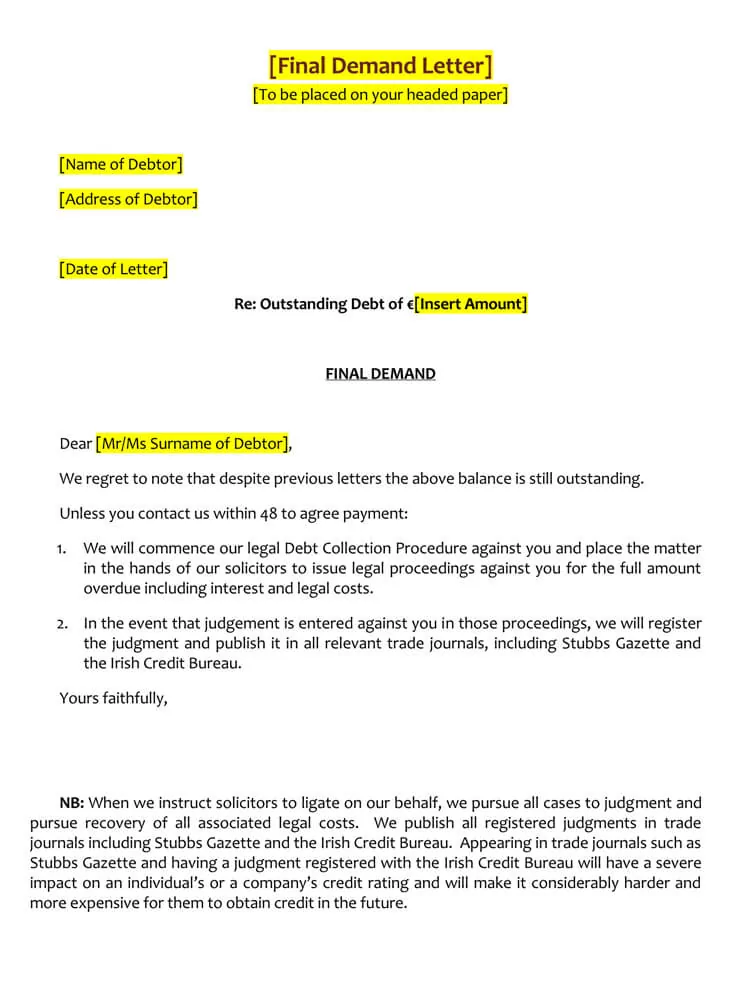

Payment Reminder Email How To Write 24 Samples

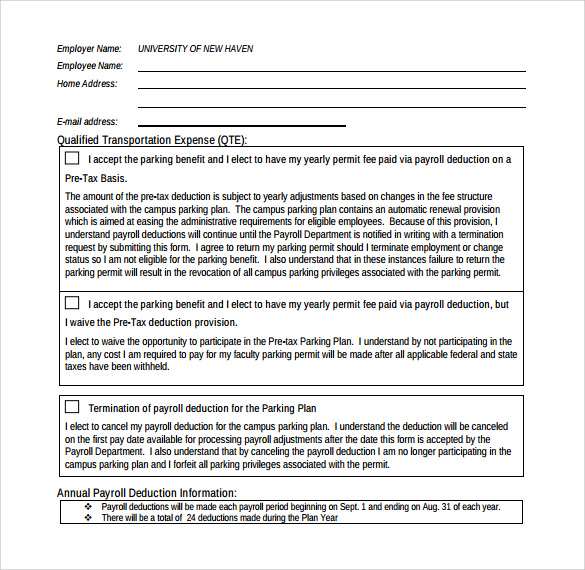

Free 9 Sample Payroll Deduction Forms In Pdf Ms Word

Kiplinger Tax Letter Lettering Tax Tax Rules

Payment Reminder Email How To Write 24 Samples

Payment Reminder Email How To Write 24 Samples

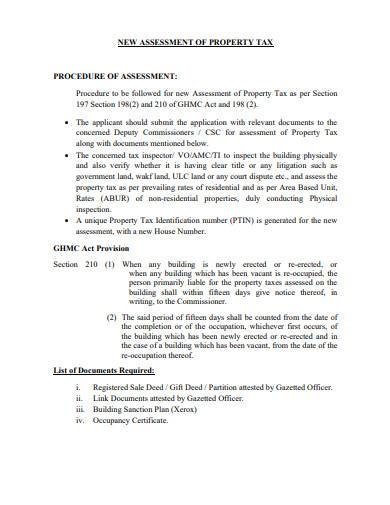

Free 10 Property Tax Samples In Pdf Ms Word

24 Employment Verification Letter Samples How To Write

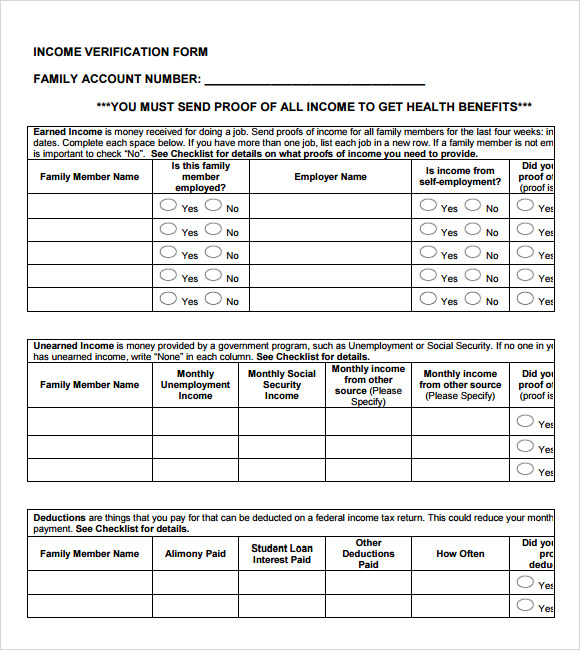

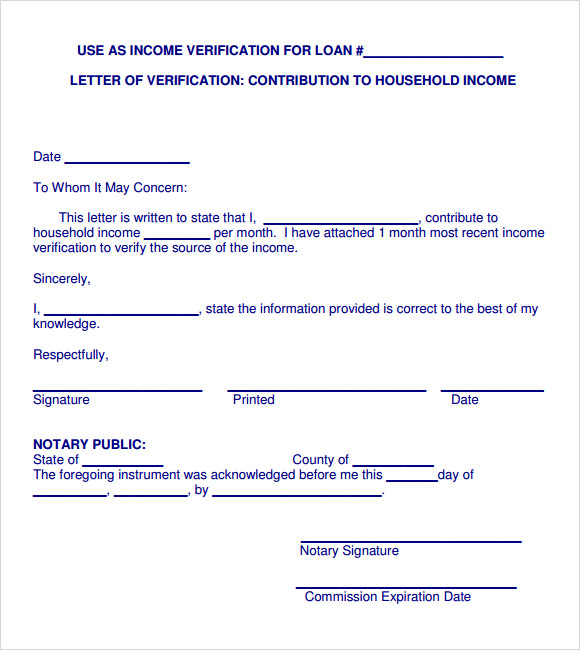

Free 6 Proof Of Income Letter Templates In Pdf

Free 6 Proof Of Income Letter Templates In Pdf

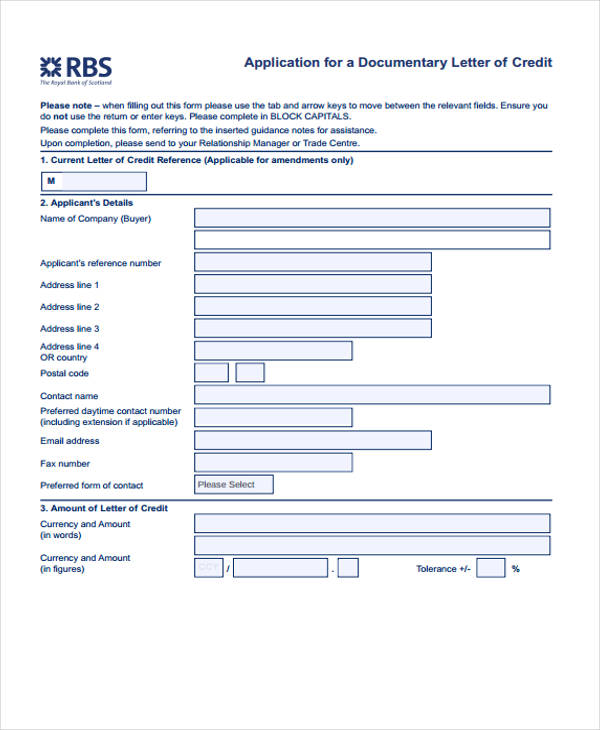

Free 24 Credit Application Forms In Pdf

24 Employment Verification Letter Samples How To Write

State Farm Liability Auto Insurance In 2021 State Farm Insurance Insurance Printable Insurance Policy

Leave Letter Formats 24 Free Printable Word Pdf Text Sample Resume Templates Official Letter Format Letter Templates Free

Bill Of Lading Templates 24 Free Printable Xls Docs Bill Of Lading Classroom Newsletter Template Bills

Leave Letter Formats 24 Free Printable Word Pdf Text Lettering Letter Templates Free Marriage Rights

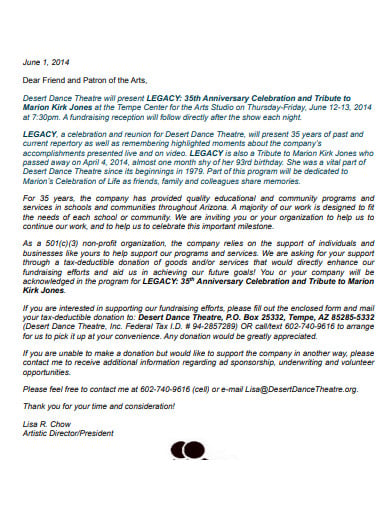

24 Donation Request Letter Templates In Google Docs Word Pdf Pages Free Premium Templates